“As someone working in the adult industry and paid in USDT, traditional card solutions always felt limiting or untrustworthy. Kinetic changed everything. I now have a reliable virtual and physical card I can use anywhere, groceries, travel, subscriptions, without fear of rejection or judgement. It’s empowering and truly seamless.”

Login

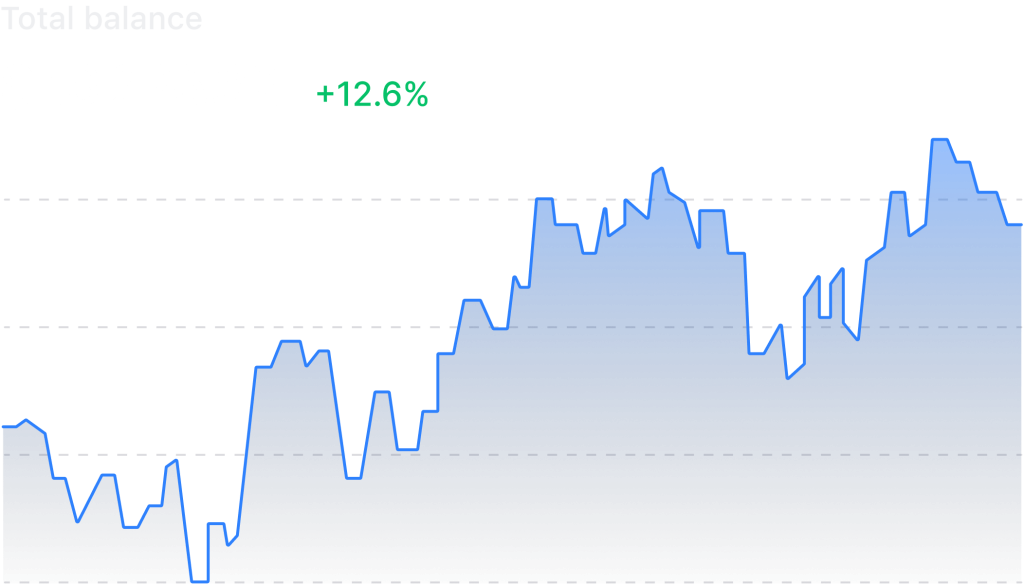

Instant, seamless, and compliant spending.

Kinetic‑Pay delivers the next-generation of crypto card payment solutions, specifically

designed for high-risk sectors and digital asset natives, Kinetic makes spending your digital

assets seamless.

More than just a crypto card.

Innovation

Kinetic‑Pay redefines financial freedom with a crypto card purpose-built for high-risk sectors,

blending compliance, flexibility, and on-chain liquidity.

Technology

Our infrastructure connects digital assets to global payment rails in real time, enabling

seamless crypto-to-fiat card transactions without friction.

Security

Built for trust, Kinetic‑Pay ensures every transaction meets the highest security standards with AML controls, tokenised payments, and real-time monitoring.

Browse our crypto spending services

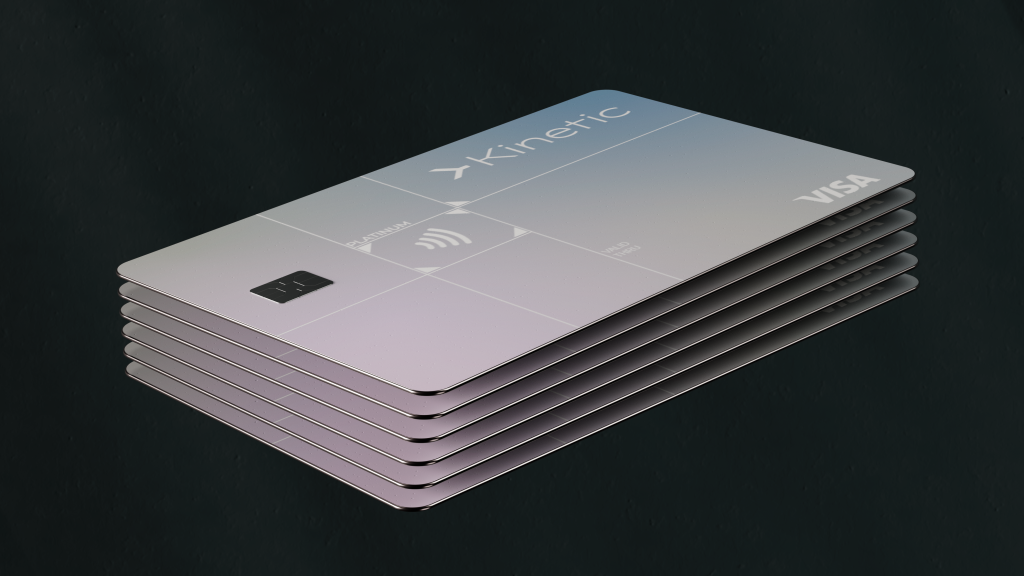

KYC Cards

Our KYC crypto cards, available virtually via Apple Pay and Google Pay, and now as

physical cards, support deposits up to $175,000 per month in BTC, ETH, XRP, USDT, SOL, ADA, and more. Enjoy compliant, high-limit access to your favourite digital assets.

Non-KYC Cards

Our Non-KYC crypto cards offer instant access via Apple Pay and Google Pay, plus physical card options. Deposit up to $150 per load in BTC, ETH, XRP, USDT, SOL, ADA, and others. A discreet, flexible solution for crypto-native users with minimal entry

Designed to support your digital asset spending challenges.

For Entrepreneurs

Empower individuals, entrepreneurs, gig-economy workers, and digital asset natives

For Crypto Natives

Seamless, instant, borderless payments without the friction.

For Entrepreneurs

Digital and online workers prefer stablecoins: fast, global, secure spending.

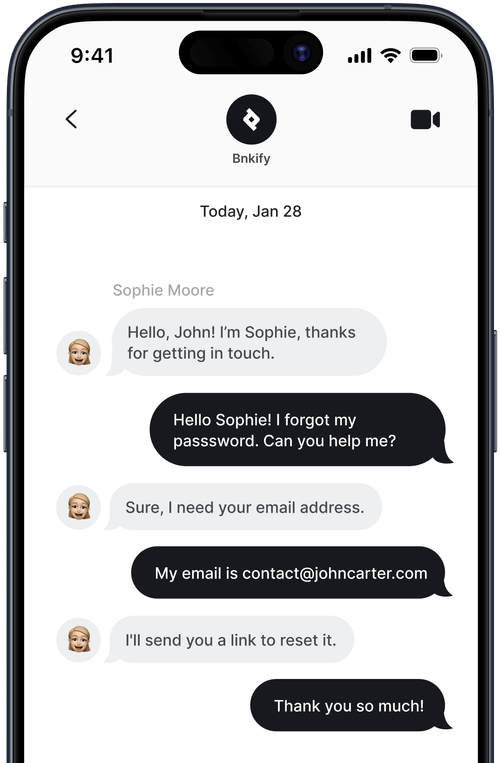

At Kinetic we go the extra mile, providing the customer support you need to ensure any challenges are resolved as swiftly as sending a payment.

Experience exceptional customer support via WhatsApp Business Chat, fast, responsive, and tailored assistance whenever you need it, wherever you are.

Open your account today and experience the next-gen crypto payments.

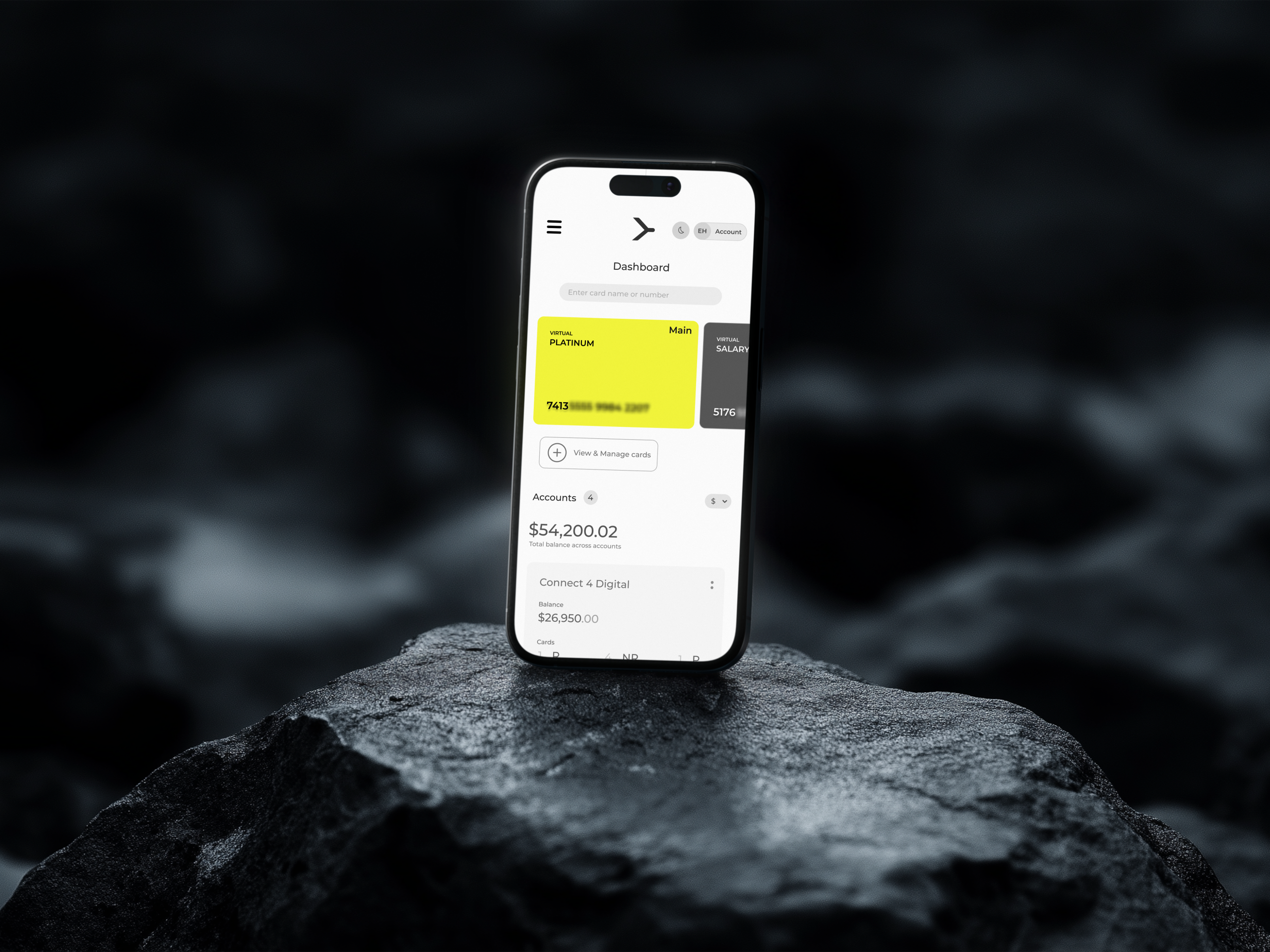

Opening a Kinetic account revolutionises how you spend your digital assets, whether

it’s your salary, commissions, or crypto gains. Say goodbye to frustrating geo-restrictions and card declines abroad. Kinetic offers seamless global spending with virtual and physical cards, giving you true financial freedom. Our platform eliminates the common pain points of crypto cards, delivering a smooth, secure, and borderless payment experience designed for today’s mobile, global user. It’s crypto spending, without compromise.

Customers and growing

0

+

Spending volume to date

M

Cards issued

0

K+

Total spend processed

$

M+

Uptime & approval rate

%

What our clients think about us

Opening a Kinetic account revolutionises how you spend your digital assets, whether

it’s your salary, commissions, or crypto gains. Say goodbye to frustrating geo-restrictions and card declines abroad. Kinetic offers seamless global spending with virtual and physical cards, giving you true financial freedom. Our platform eliminates the common pain points of crypto cards, delivering a smooth, secure, and borderless payment experience designed for today’s mobile, global user. It’s crypto spending, without compromise.

“I operate across gaming, casinos and high-end hospitality, often moving between jurisdictions. Off-ramping digital assets was a constant headache, especially with cards failing abroad due to geo-blocking. Kinetic has solved this completely. I now travel and spend confidently, with direct access to my crypto whenever and wherever I need it.”

Entrepreneur – Gaming, Casinos & Hospitality

“Our crypto casino struggled for years to find a banking partner to manage player rewards and membership payouts. With Kinetic, every verified customer now receives their winnings via a branded VISA card, instantly usable in-store or online. It’s added professionalism, flexibility, and trust to our entire payout model.”

Business – Online Crypto Casino

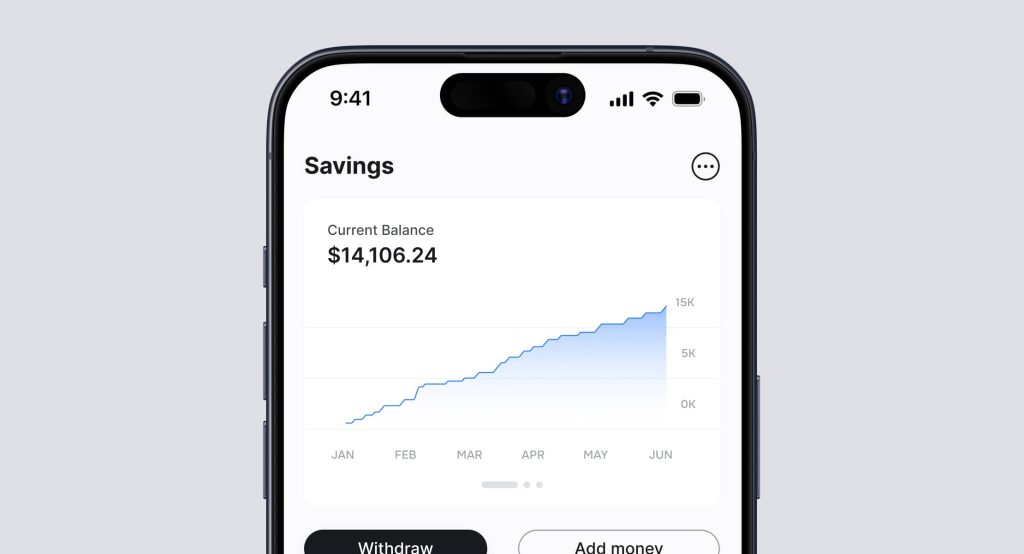

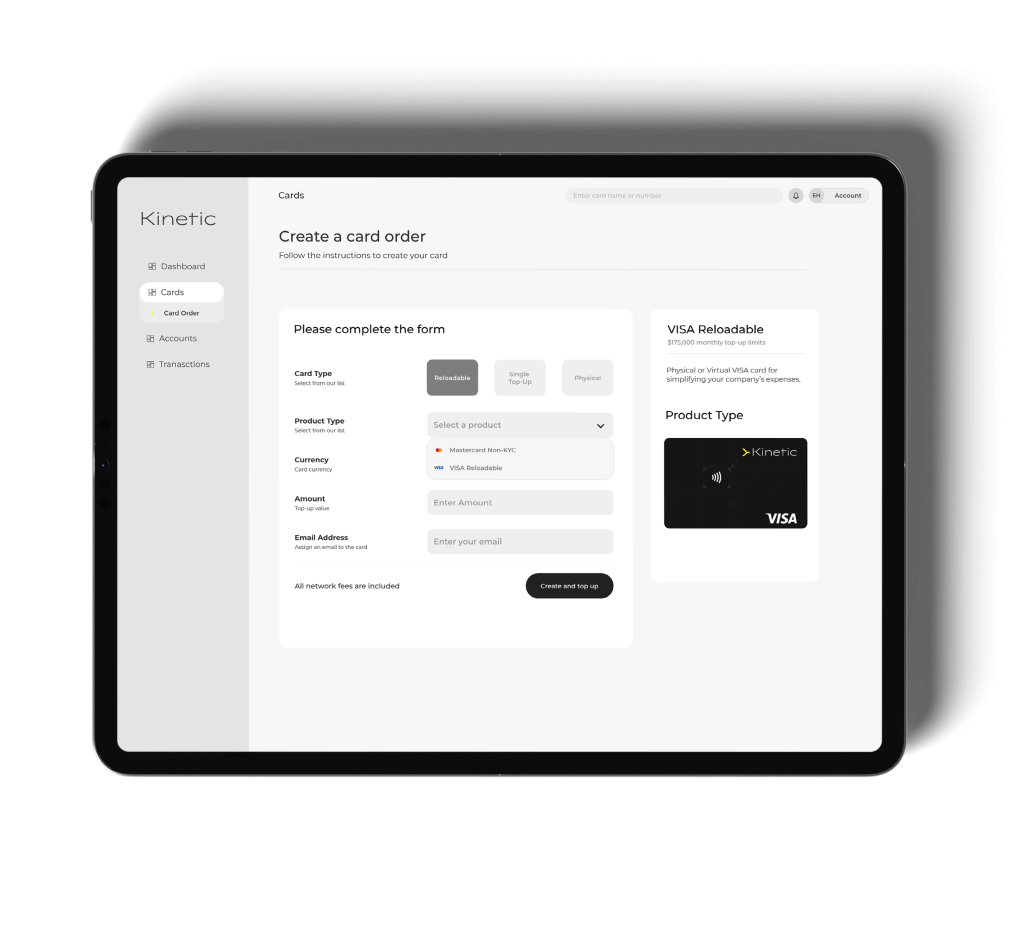

Explore the Kinetic platform, super simple to use, fast payments, and built for real-world crypto spending.

Kinetic’s platform features a super clean, intuitive design, making crypto spending

simple, stress-free, and seamless.

We leverage best-in-breed infrastructure, including VISA and Mastercard payment

rails, to ensure global, fast, and frictionless transactions.

Discover our mission

At Kinetic Pay, we believe in financial liberation through technology. Born from the need for real-world crypto usability, we built a platform that empowers you to spend smartly, live freely, and manage life’s expenses—seamlessly and securely.

Frequently Asked Questions (FAQ)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Who is Kinetic Pay?

Kinetic Pay is a specialist brand created by industry leaders with deep expertise in

cryptocurrency, payments, traditional finance, software development, and design. Having

experienced the challenges of the crypto card market first-hand, the team designed Kinetic

to address its limitations head-on. Kinetic partners with Cipherwave Technologies, a

regulated payment service provider, to power the next generation of flexible, high-limit crypto

card payments.

Where is Kinetic Pay regulated?

Kinetic Pay operates as a brand of Cipherwave Technologies, which holds both a Payment

Service Provider (PSP) licence and a Virtual Asset Service Provider (VASP) licence in

Poland and Georgia. These regulatory foundations allow us to serve global users with

compliance and confidence.

How are my assets securely stored?

Your crypto assets are held with regulated custodians in secure custody wallets. Upon

loading funds, your assets are swapped through licensed exchange partners providing FX

liquidity, with custody maintained in accordance with international standards. For full

transparency, please refer to our custodians’ terms and conditions.

Does Kinetic work globally?

Yes. Kinetic leverages direct banking relationships and access to VISA and Mastercard

payment rails, ensuring your virtual or physical card can be used anywhere these schemes

are accepted—online, in-store, and across borders.

What KYC is conducted?

Kinetic follows strict AML, KYC, and risk management procedures aligned with global

regulatory standards. All onboarding is completed through our integration with SumSub, enabling secure, compliant customer verification. Virtual cards can typically be issued in under 10 minutes following registration and approval.

Do you offer physical cards?

Yes. While we prioritise virtual card issuance for environmental reasons, physical cards are available for users who prefer them for in-person or international transactions.

Can I send and receive crypto from a wallet?

Not currently. Kinetic is not a self-custody wallet. Users can send digital assets to their Kinetic account, which are automatically converted into local currency and made available for card spending. In 2026, we plan to launch Kinetic Custody, a self-custody wallet enabling crypto transfers.

Do you offer Non-KYC cards?

Yes. Kinetic offers Non-KYC cards, which provide full virtual and physical card functionality but are limited to $150 per card in accordance with applicable regulatory thresholds.

What are the card limits?

Kinetic cards allow users to deposit and spend up to $175,000 per month, making them

suitable for high-value purchases, business expenses, and liquidity access.

What other products are planned?

In 2026, we will expand beyond crypto card payments to offer:

- Kinetic Custody – Self-custody wallet for crypto storage and wallet-to-wallet transfers

- Kinetic DEX – A decentralised exchange for token swaps

- Kinetic Invest – A platform to invest in commodities like precious metals

- Kinetic Stake – Staking of digital assets via approved exchange partners

What exchanges provide your liquidity?

We currently utilise a combination of regulated and institutional-grade liquidity providers including [X], [Y], and [Z] to enable efficient crypto-to-fiat conversions and real-time settlement for card spending.